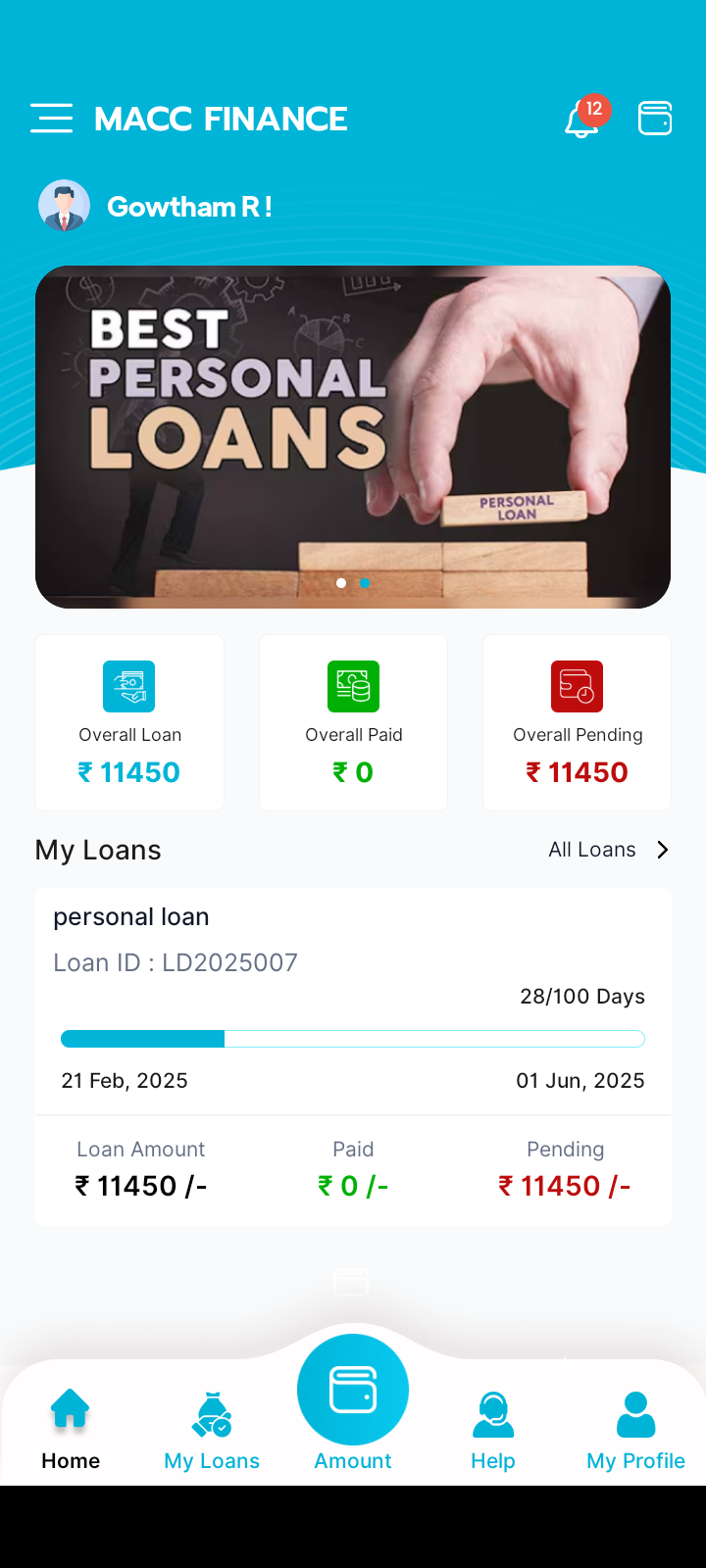

To revolutionize the finance industry, we are dedicated to introducing innovative solutions that streamline financial processes, making them efficient and accessible. By leveraging cutting-edge technology, we aim to transform traditional financial services, providing a seamless and secure user experience in small business loan. Our goal is to set new industry standards, driving growth and fostering continuous improvement and innovation

Our mission is to create an accessible, equitable lending environment tailored to diverse borrower needs. We aim to break down barriers and ensure financial opportunities for everyone, regardless of background. By offering flexible and inclusive lending solutions, we strive to empower individuals and communities to achieve their financial goals and build a brighter future.

India's rapid economic growth and the booming fintech sector present prime opportunities for MACC Finance. By leveraging technological advancements, MACC Finance can offer accessible, flexible, and regulated loan and financial solutions. This positions the company to meet the growing demand and serve the underserved market effectively.

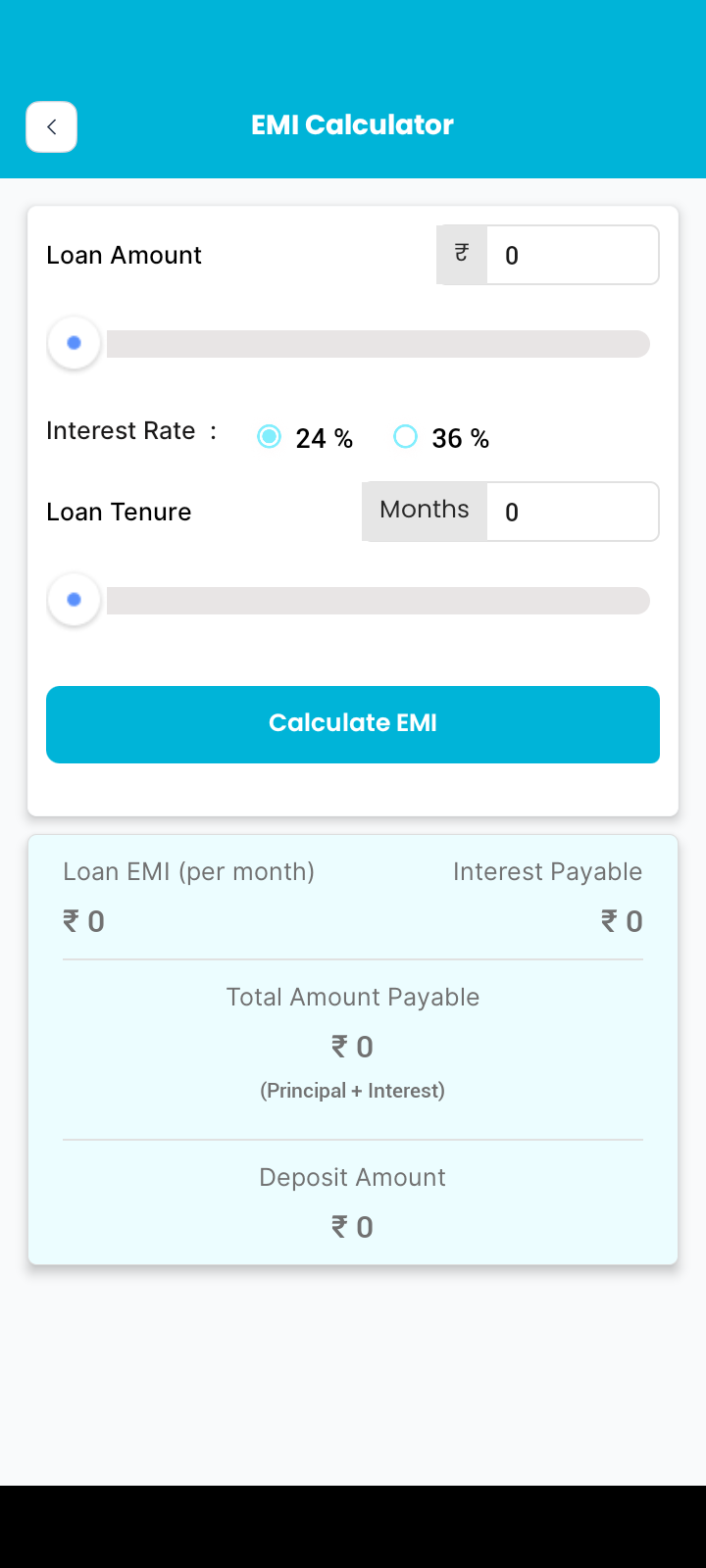

We provide school fee loans against a deposit amount of up to 200% or 300%. Make a one-time deposit with us, and we will cover all of your child's annual fees. You can repay the amount over time as EMI.

Conditions

Note

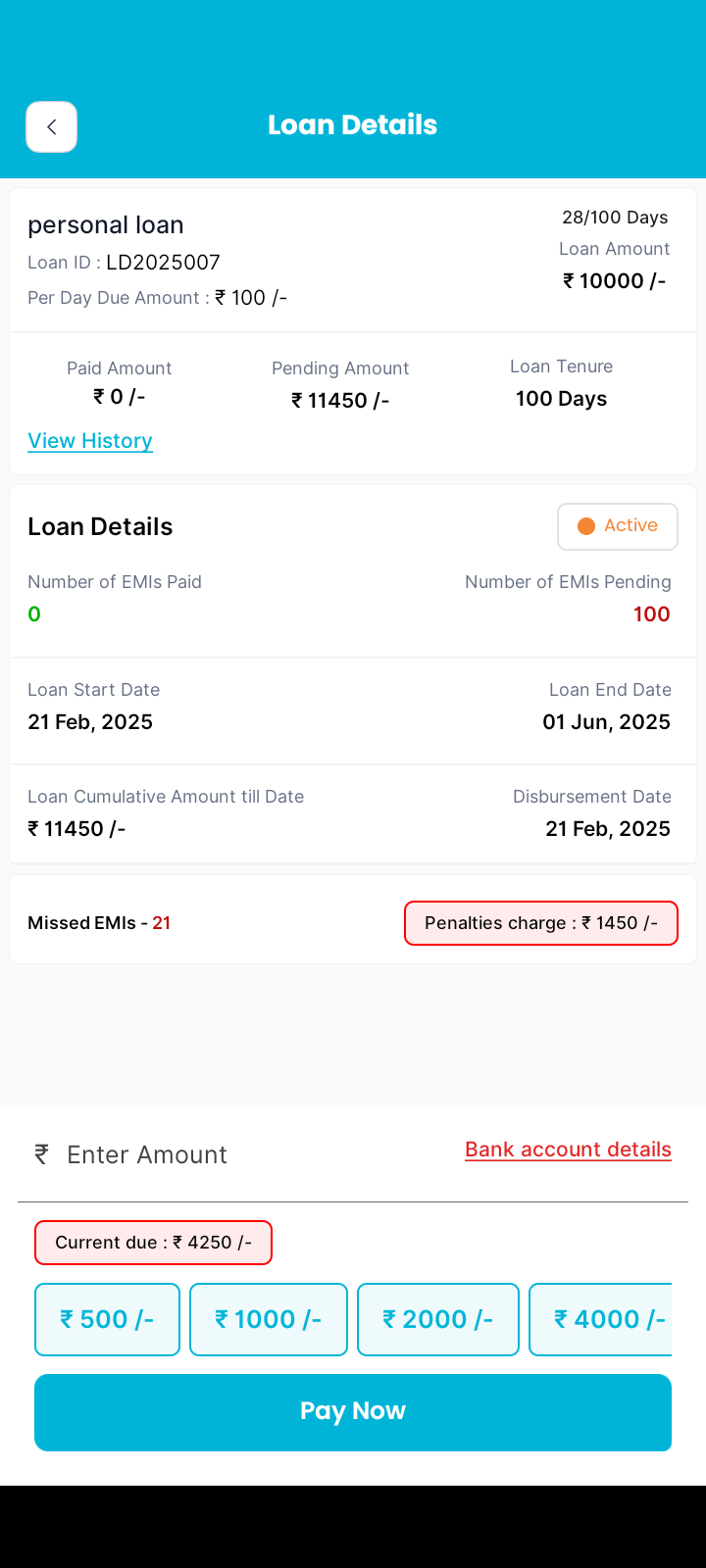

Are you a small business owner looking for quick and hassle-free financing? Our Small Merchant Loan is designed to help you manage cash flow, expand inventory, upgrade equipment, or meet unexpected expenses with ease.

Who Can Apply?

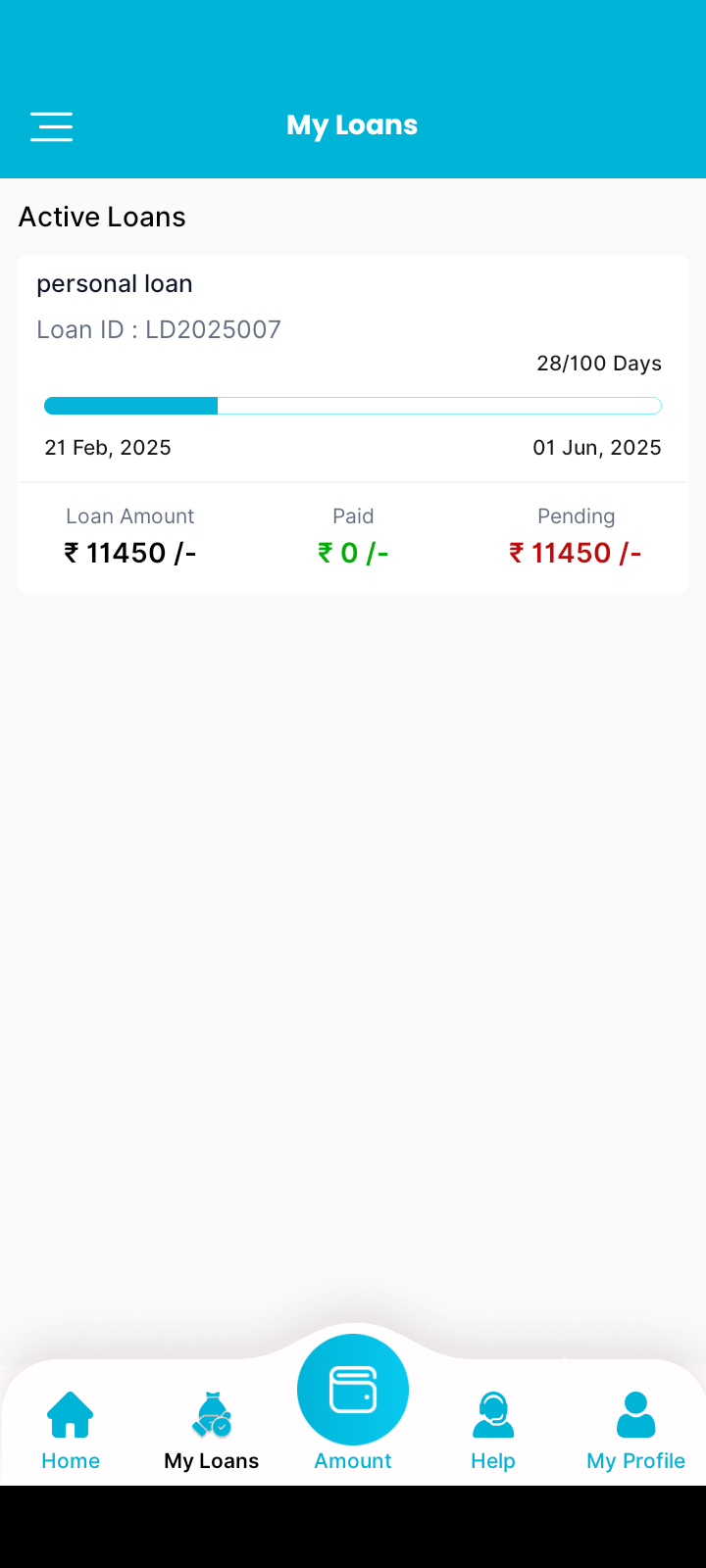

Seamless and secure! I feel confident managing my investments and transactions through this app.

This app has completely changed the way I manage my finances

The app interface is very user-friendly. Highly recommended